Hello reader, hope you’re doing well. Back after a week’s hiatus as I’d been travelling. Local stocks showed early signs of optimism as the SGX Nifty experienced significant gains following a higher closing in the US markets on Friday. However, the overall sentiment has been shaken by the unexpected interest rate hike by the Bank of Canada, leading investors to worry about the possibility of a hawkish stance by the Federal Reserve during this week’s FOMC meeting. Meanwhile, domestic investors are closely monitoring the upcoming announcements of the CPI inflation numbers for May and the industrial production figures for April, which will provide insights into the state of our economy following strong performance in the previous month. From a technical perspective, the Nifty faces potential downside risks at 18463, while the Nifty Bank index demonstrates a more resilient risk appetite as it aims to surpass its previous record high at the 44499 level.

Important points to note:

- Nifty currently in the range of 18600-18800, good scope from here to touch new highs of 18900-19000 soon.

- Banknifty consolidating in a 1000 point range for the last one month. Need HDFC Bank, Axis, ICICI to lead it towards new highs from here on out.

- PSE basket continues to be the top gainer even in such a rangebound market, this clearly shows outperformance amongst all sectors.

- With VIX being very low at 11.31 levels, better to stay away from option selling trades as premiums are quite low and opportunities haven’t presented themselves yet. Once it goes back above 12-12.5 levels, we can look out for fresh trades on index and stock options as well.

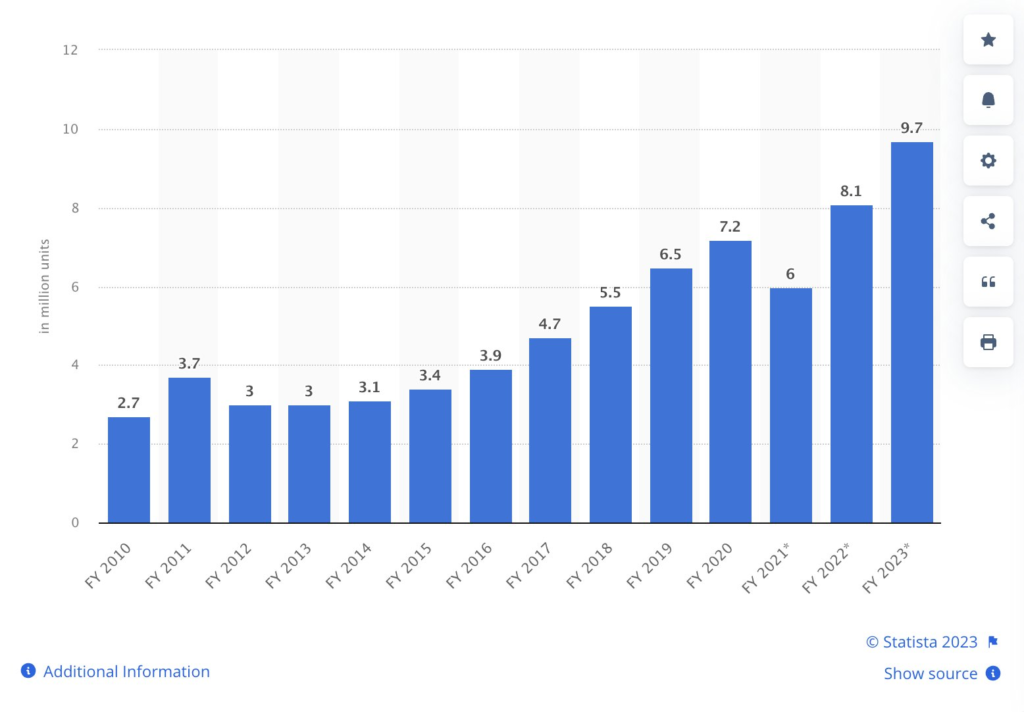

India AC sales rising over time. Singapore’s founder-leader Lee Kuan Yew had once said: “Air conditioning was a most important invention for us, perhaps one of the signal inventions of history. It changed the nature of civilization by making development possible in the tropics.”

As always, risk management is key, and a proper system in place prevents one from losing out too much, in case of outlier events. Have a good trading day, and may the force be with you!

Disclaimer: this post is for educational purposes only, we are not SEBI registered analysts. Trades mentioned here are not trade recommendations. Equity Investments are subject to 100% market risk, please consult your financial advisor before investing.

Glad to have you back!