Hello reader, hope you’re doing well. While markets may see a flat opening in Tuesday trades with a slightly negative bias, the undertone could remain positive if benchmark Nifty stays above the 19227 mark. The risk mood has improved considerably as Friday’s softer than expected US August payrolls report suggests that September rate hike could be off the table. Technically, after the last two days’ sharp rebound, Nifty’s 19650 zone shall be the major hurdle to cross. However, a cause of concern in the near to medium term will be the erratic monsoon spell, and if the rains play truant, inflation factor will once again come into play, which could hurt market sentiment going ahead.

Important points to note:

- Nifty after forming a good base, close to it’s immediate resistance zone of 19600-650, crossing this can be the start of a new rally.

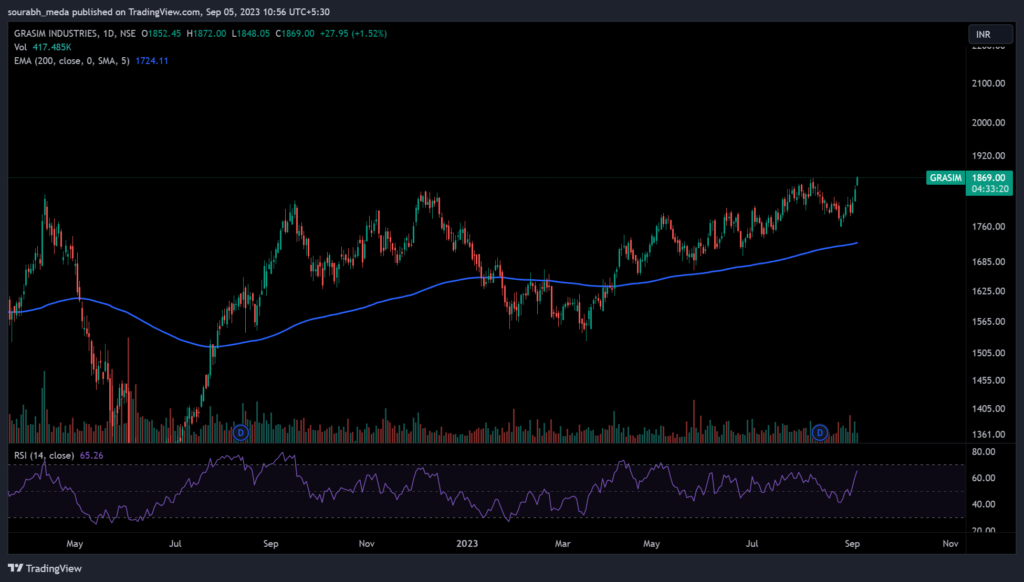

- Grasim has given a breakout from the 1850 zone which has been the key point to cross in the last 1.5 years.

- In the PSE basket, few stocks like NTPC, PFC and REC are showing signs of cooling off after a good 3 month rally, can look at partial exits if holding these names in portfolio.

- Thanks to a stellar run in its shares this year, IDFC First Bank has entered the elite club of 10 most valuable listed lenders in India, replacing Union Bank of India and Canara Bank with a valuation of Rs 65,325 crore as of September 4.

- Nifty MidCap breaches 40,000 mark first time, SmallCap index scales record high as well.

As always, risk management is key, and a proper system in place prevents one from losing out too much, in case of outlier events. Have a good trading day, and may the force be with you!

Disclaimer: this post is for educational purposes only, we are not SEBI registered analysts. Trades mentioned here are not trade recommendations. Equity Investments are subject to 100% market risk, please consult your financial advisor before investing.