Hello reader, hope you’ve had a good weekend. Amidst a backdrop of positive factors and an optimistic market sentiment, the SGX Nifty stands out with a vibrant green color, symbolizing its strength. With the Nifty aiming to reach new heights at 18888 and the Bank Nifty following suit, targeting to surpass its previous record of 44153, the path to success appears clear, supported by aligned technical indicators and a prevailing bullish momentum. Additionally, with promising monsoon forecasts, increasing GDP growth projections, and the confidence displayed by both foreign and domestic investors, conditions are set for a potential halt in the Federal Reserve’s rate hike. Furthermore, the relentless rally in the Nasdaq and S&P 500 indices adds further fuel to the market’s momentum. In light of these favorable circumstances, let us embrace the bullish opportunities presented by Indian Hotels, TCS, and Reliance Industries. By capitalizing on any corrective declines during the week, we can aim to achieve gains.

Important points to note:

- The coming week marks the beginning of the new month also so participants will be eyeing high frequency data viz. auto sales, manufacturing PMI and services PMI data. Before that, the GDP data, scheduled on May 31, will also be on their radar.

- Apart from these factors, the performance of the US markets amid the ongoing debt ceiling talks will be in focus.

- 44500 to be a key resistance point on Banknifty and 18800 on Nifty.

- PSE basket continues to outperform even now, 5000 on CNXPSE is a good target to expect in the short term.

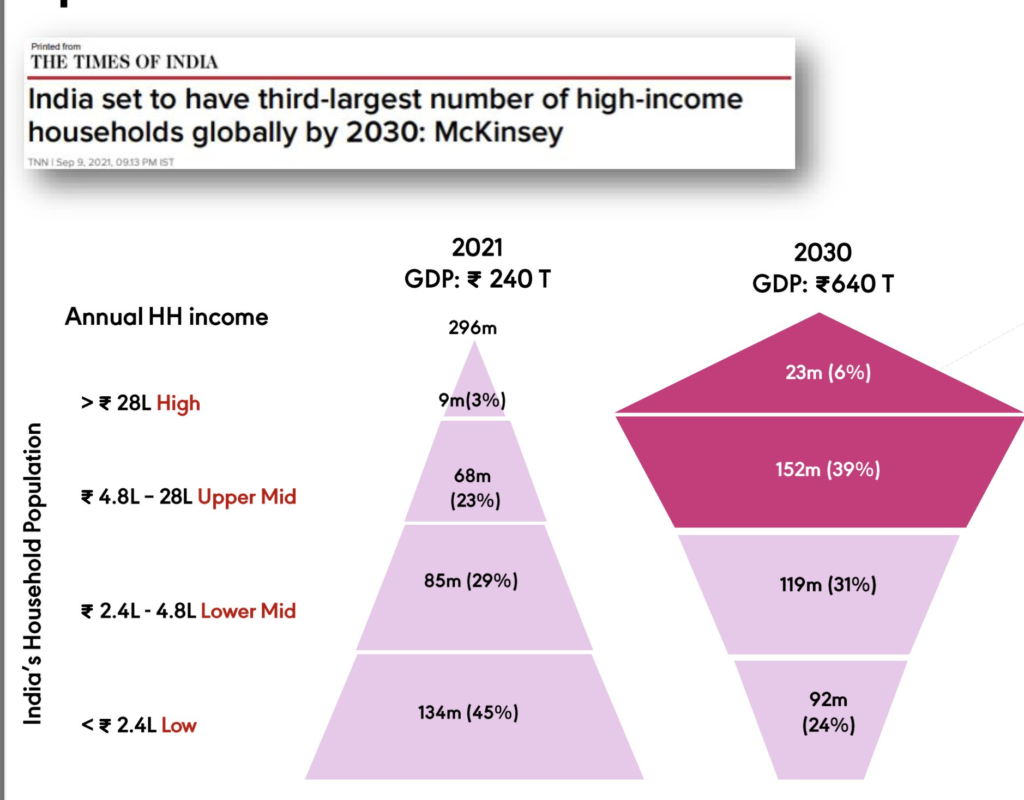

- Discretionary consumption like automobiles, jewellery, apparel, white goods, tourism, fitness, wellness, personal grooming, home improvement, dinning, credit cards, etc. can witness good growth phase in next few years.

As always, risk management is key, and a proper system in place prevents one from losing out too much, in case of outlier events. Have a good trading day, and may the force be with you!

Disclaimer: this post is for educational purposes only, we are not SEBI registered analysts. Trades mentioned here are not trade recommendations. Equity Investments are subject to 100% market risk, please consult your financial advisor before investing.