Hello reader, hope you’re doing well. Positive global indicators and increased investor confidence are expected to result in a strong opening for the markets. Foreign institutional investors have been actively buying shares, encouraged by a temporary decrease in inflation, which reached its lowest point in 18 months in April. As inflation continues to decline, there is optimism in the market that the pause on interest rate hikes will be sustained, allowing for sustained growth momentum in the future. From a technical standpoint, it is important to monitor the Nifty index’s significant support level at 18287. If the index falls below this level, the next support level to watch for is at 18195.

Important points to note:

- Nifty consolidating just before the key breakout zone of 18400.

- Highest OI concentration at this level, 1.29cr vs 1.08cr on 18300 PE side.

- PSE index gearing up for a breakout post consolidation again, above 4845 levels we can see a good upmove until 4900-5000 levels.

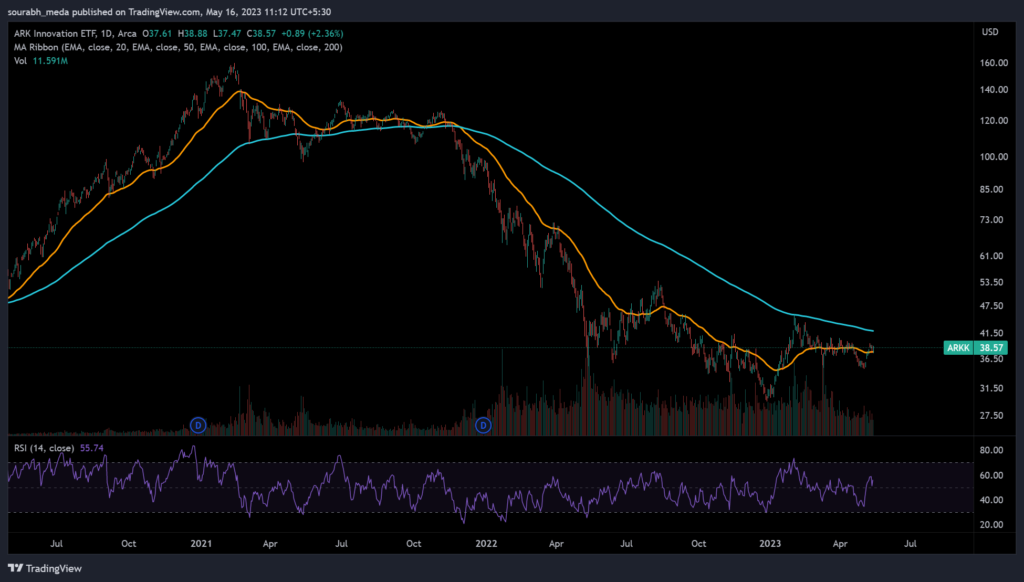

- ARKK was the poster boy of the bull market in US and has taken a big beating since it topped out in 2021, and has been struggling to cross 200 DMA. If it does cross these levels, it would be a very bullish sign for broader US markets.

- DLF being the major gainer in realty sector, along with Sobha too, need to wait for others to catch up from current levels.

As always, risk management is key, and a proper system in place prevents one from losing out too much, in case of outlier events. Have a good trading day, and may the force be with you!

Disclaimer: this post is for educational purposes only, we are not SEBI registered analysts. Trades mentioned here are not trade recommendations. Equity Investments are subject to 100% market risk, please consult your financial advisor before investing.

How do I understand the graph?

This post was nice – it made me google a few things.