Hello reader, hope you’re doing well. Early trades today are expected to see markets trading higher, buoyed by positive sentiment in global equities. However, caution may be warranted as there could be intra-day volatility, given that SGX Nifty has erased nearly all of its gains. Nevertheless, investors can take comfort in the fact that both FIIs and DIIs purchased shares worth Rs 1,245 crore and Rs 823 crore respectively on Wednesday. Furthermore, the declining US Treasury yields are viewed positively by investors, indicating that the market is anticipating a more accommodative stance by the Federal Reserve in the future. From a technical standpoint, the Nifty is likely to find intraday support at the 17000 mark, while Bulls will be targeting the clearance of the 200-DMA at the 17475 mark.

Important points to note:

- Nifty to consolidate in current range of 17000-300 for the short term now. Important to see if gap gets filled on downside, will make charts structurally better for further upside.

- Currently it’s only Reliance and ICICI bank which are holding up Nifty and Banknifty, key for other stocks to also perform and help in improving overall market breadth.

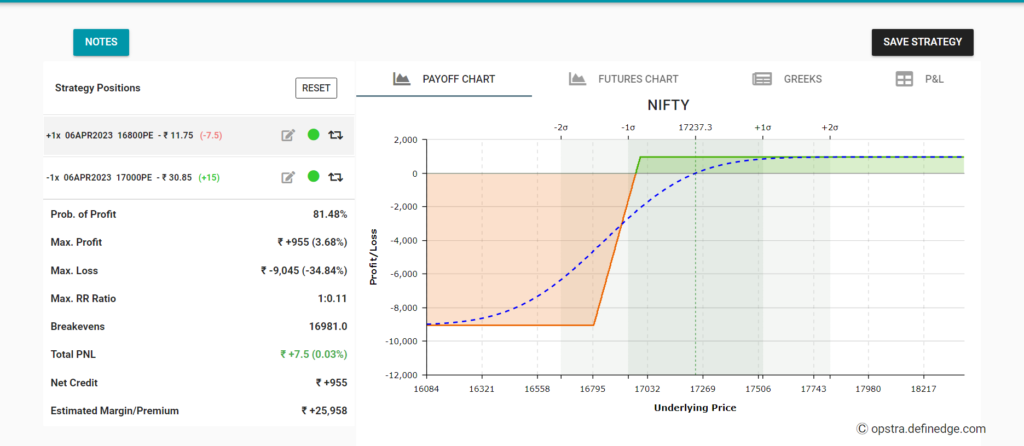

- 17000 to act as major support for Nifty from now, one can take a good hedged trade by shorting 17000 PE and adding a hedge at 16800 PE for the current week expiry.

As always, risk management is key, and a proper system in place prevents one from losing out too much, in case of outlier events. Have a good trading day, and may the force be with you!

Disclaimer: this post is for educational purposes only, we are not SEBI registered analysts. Trades mentioned here are not trade recommendations. Equity Investments are subject to 100% market risk, please consult your financial advisor before investing.