Hello reader, hope you’ve had a good weekend. During Sunday’s evening trading, U.S. stock futures rose by almost 1%, following a week where the major indices experienced significant drops. This was due to the assurance made by Federal Reserve policymakers that depositors with SVB Financial will be able to access their funds. This week for our markets is expected to be marked by volatility, with greater attention paid to global indicators such as US inflation, the ECB’s interest rate decision, and Chinese industrial production figures.

Important points to note:

- Post the gains in global markets overnight, SGX Nifty indicates a slightly flat opening with a positive bias.

- 17300 as mentioned earlier is the key bottom to be held, for the markets to sustain at current levels and form a base for further moves.

- Highest OI is currently at 17500 CE on Nifty which will act as primary resistance in the short term. Similarly, on Banknifty the highest concentration is at 41500 CE, which will act as key resistance, more momentum on upside once 42000 levels are crossed.

- Even during the fall on Friday, Nifty PSE index was the major outperformer, which shows us the relative strength of the sector as compared to others, more of the same to follow.

- PCR levels currently at 0.68, on Nifty.

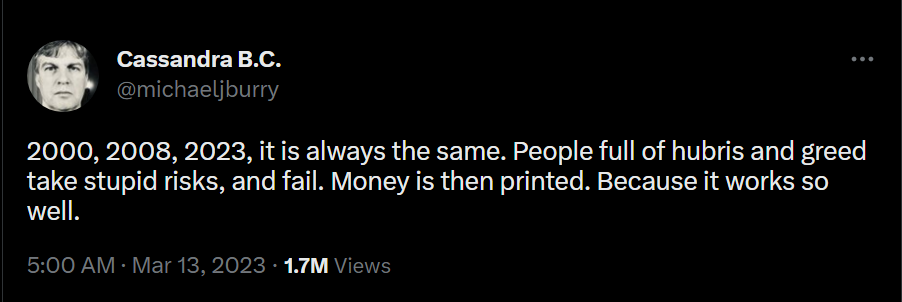

One interesting observation over the weekend has been that the 2008 financial crisis star, Michael Burry has again put out a message about an impending market crash. Apparently, Burry was criticised by the Fed after 2008 for questioning Fed’s negligence to pre-GFC era. It’s is quite obvious that he has become really bitter of the Fed for how he got treated, and he has become a mascot of the Howard Marks quote of ‘Expert who got famous for being right once’.

As always, risk management is key, and a proper system in place prevents one from losing out too much, in case of outlier events. Have a good trading day, and may the force be with you!

Disclaimer: this post is for educational purposes only, we are not SEBI registered analysts. Trades mentioned here are not trade recommendations. Equity Investments are subject to 100% market risk, please consult your financial advisor before investing.