Hello reader, hope you’re doing well. U.S. stock indexes closed up on Thursday as signs of slowing wage pressure on inflation raised hopes the Federal Reserve will pause raising interest rates in two weeks, and investors welcomed a vote in Congress to suspend the U.S. debt ceiling. Asian stocks surged on Friday as the progress on the bill to raise U.S. debt ceiling and increasing hopes that the Federal Reserve might stand still on interest rates in its next meeting helped perk up investor appetite for risky assets.

Important points to note:

- A dominant economic trend which has implications for investment is India’s improving economic fundamentals in a challenging global environment.

- Apart from the better-than-expected FY23 GDP growth rate, high frequency indicators like GST collections, manufacturing PMI, auto sales in May and impressive credit growth indicate a robust and steadily improving economy.

- FY24 GDP growth is likely to be revised up to around 6.5 % and consequently corporate earnings for FY24 also will be revised up. This scenario, in the context of inflation (4.7% in April) coming within RBI’s tolerance limit and peaking of interest rates, augurs well for equity markets.

- An important trend in the market is the outperformance of the broader market. We can expect lots of stock specific action even within range-bound movement of the Nifty.

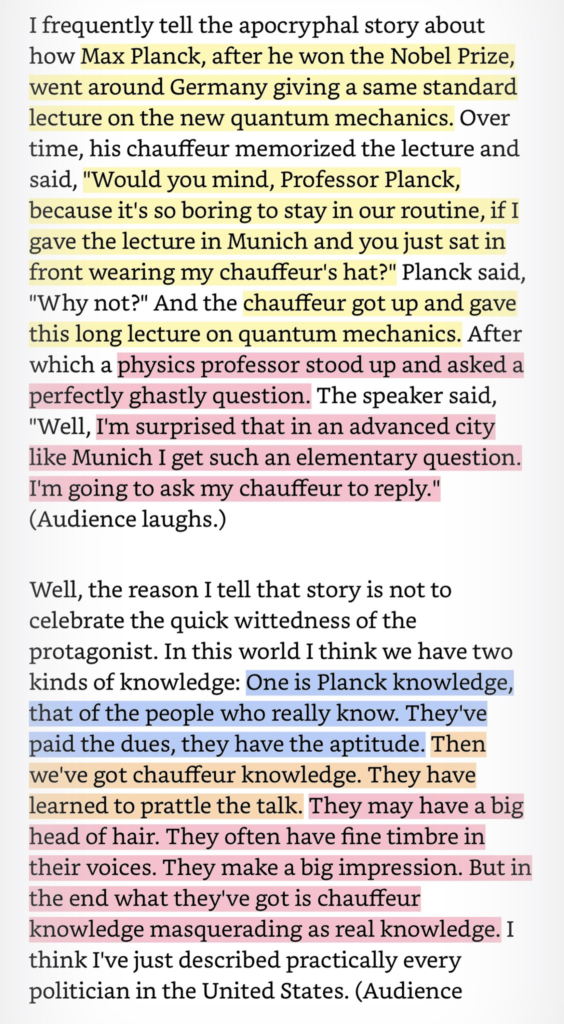

A tiny tidbit for today, from Charlie Munger, on knowledge – “In this world I think we have two kinds of knowledge: One is Planck knowledge, that of the people who really know. They’ve paid the dues, they have the aptitude. Then we’ve got chauffeur knowledge. They have learned to prattle the talk. They may have a big head of hair. They often have fine timbre in their voices. They make a big impression. But in the end what they’ve got is chauffeur knowledge masquerading as real knowledge.” It’s always important to be able to differentiate between the two.

As always, risk management is key, and a proper system in place prevents one from losing out too much, in case of outlier events. Have a good trading day, and may the force be with you!

Disclaimer: this post is for educational purposes only, we are not SEBI registered analysts. Trades mentioned here are not trade recommendations. Equity Investments are subject to 100% market risk, please consult your financial advisor before investing.

Loved the tidbit!