Hello reader, hope you’re doing well. Markets may see a sluggish start to Tuesday’s trading session on the back of a steady decline in Gift Nifty index and other select Asian gauges. While the markets may witness intra-day volatility, strong corporate earnings so far coupled with healthy domestic macroeconomy and rising expectations that the Fed will pause its rate hikes sooner than later could help local markets sustain the recent upsurge. Investors are looking forward to large corporate earning numbers this week from Infosys, Hindustan Unilever and Reliance Industries, which would provide some hint on whether blue chips have managed well to weather the global economic storm or have felt the pinch. Technically, Nifty faces hurdle at 19800 zone, with support placed at 19500 zone.

Important points to note:

- Nifty consolidating near the 19800 zone for the day.

- NTPC and Powergrid at good buying levels for further upside from here.

- USD-INR is one currency pair which looks good for a short trade setup from current levels. Breakdown below 82 levels will open up the path towards 79/78 first, then towards 75 levels.

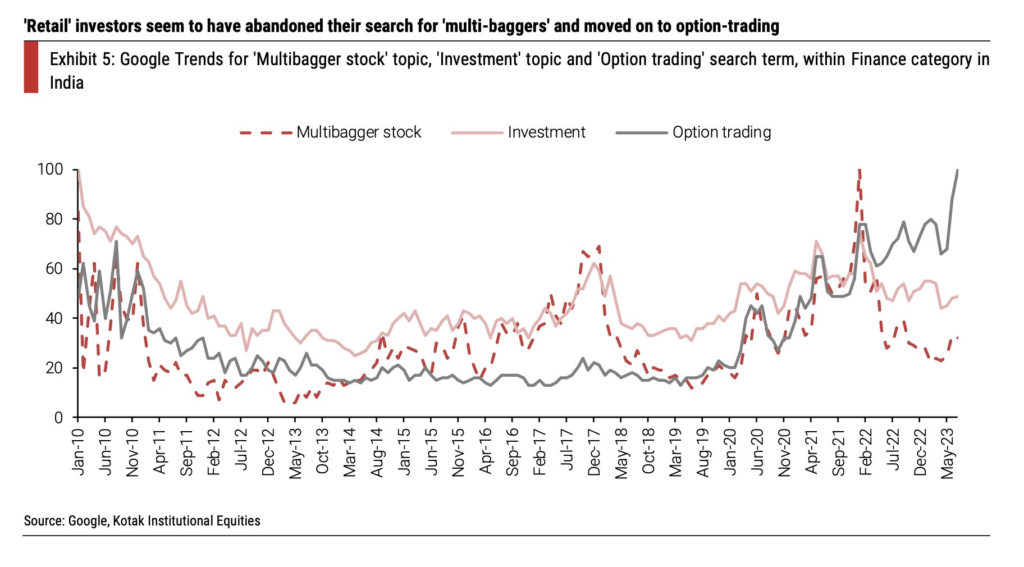

An interesting thing to note, Google Trends for:- Multi-bagger vs Investment vs Option Trading.

As always, risk management is key, and a proper system in place prevents one from losing out too much, in case of outlier events. Have a good trading day, and may the force be with you!

Disclaimer: this post is for educational purposes only, we are not SEBI registered analysts. Trades mentioned here are not trade recommendations. Equity Investments are subject to 100% market risk, please consult your financial advisor before investing.