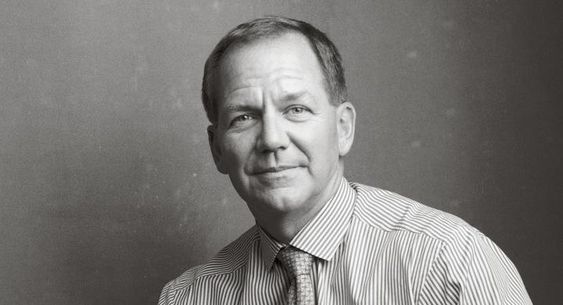

Paul Tudor Jones is widely regarded as one of the greatest hedge fund managers of all time. He is the founder and chief investment officer of Tudor Investment Corporation, a hedge fund that has delivered consistent returns for over 30 years. Jones is known for his aggressive, high-risk investment style, as well as his prescient calls on major market events. He has a net worth of over $7 billion and is one of the wealthiest investors in the world. In this article, we will take a closer look at Jones’ life and career and explore the strategies and principles that have made him so successful.

Early Life and Education

Paul Tudor Jones was born on September 28, 1954, in Memphis, Tennessee. His father was a lawyer, and his mother was an artist. Jones showed an early interest in finance, and in high school, he started investing in stocks. He attended the University of Virginia and earned a degree in economics in 1976.

After graduation, Jones moved to New York City and began his career as a clerk on the New York Stock Exchange. He worked for several firms before starting his own hedge fund, Tudor Investment Corporation, in 1980.

Early Career and Investment Style

Jones’ early years as a hedge fund manager were marked by aggressive, high-risk investing. He was known for making bold bets on market trends and using leverage to amplify his returns. He also developed a reputation for taking large, contrarian positions that were often out of step with the rest of the market.

One of Jones’ most famous trades was his short position on the stock market crash of 1987. In the weeks leading up to the crash, Jones had become increasingly concerned about the market’s valuation and had started taking short positions in various stocks and indices. When the crash hit, Jones’ fund made a profit of over 300%.

In the 1990s, Jones correctly predicted the dot-com bubble and positioned his fund to profit from the ensuing market collapse. He also made successful trades on the Japanese yen and the German bond market.

Jones’ investment style has been described as “global macro,” which involves taking positions on large macroeconomic trends, such as interest rates, currency fluctuations, and commodity prices. This approach requires a deep understanding of the global economy and a willingness to take big risks.

Risk Management

Despite his reputation for risk-taking, Jones has always had a strong focus on risk management. He is known for his strict risk controls and his ability to manage the downside risk of his investments. In an interview with Forbes in 2017, Jones said, “The most important thing in trading is not what you make, but what you don’t lose.”

Jones’ risk management approach involves several key principles. First, he uses stop-loss orders to limit his losses on individual positions. Second, he diversifies his portfolio across different asset classes and geographies to spread his risk. Third, he uses leverage judiciously, only using it when he sees an opportunity for outsized returns. Finally, he is always monitoring his portfolio and adjusting his positions as needed to manage risk.

Prescient Calls on Market Events

One of the hallmarks of Jones’ career has been his ability to make prescient calls on major market events. He has a reputation for being able to see trends before they become apparent to the rest of the market, which has enabled him to position his fund to profit from these events.

In addition to his successful trades on the stock market crash of 1987 and the dot-com bubble of the 1990s, Jones has made other prescient calls on major market events. In 2007, he warned of the impending subprime mortgage crisis and took positions that profited from the ensuing market turmoil.

More recently, Jones made headlines in 2020 when he predicted the market crash caused by the COVID-19 pandemic. He wrote a letter to his investors in February 2020, warning of the potential impact of the virus and urging them to take defensive measures. His fund was up 14.6% in the first quarter of 2020, while the S&P 500 was down 20%.

Jones’ ability to make these prescient calls is due in part to his deep understanding of macroeconomic trends and his ability to connect the dots between seemingly disparate data points. He also has a strong network of contacts in the financial industry, which gives him access to valuable information.

Philanthropy and Social Impact

In addition to his success as an investor, Jones has also made a significant impact in the world of philanthropy and social impact. He is the founder of the Robin Hood Foundation, a nonprofit organization that aims to fight poverty in New York City. Since its inception in 1988, the Robin Hood Foundation has raised over $4 billion and has supported hundreds of organizations working to alleviate poverty in the city.

Jones is also an advocate for environmental causes and has spoken publicly about the need to address climate change. He has pledged to donate $1 billion over the next decade to support initiatives that address the issue.

Lessons from Paul Tudor Jones

Paul Tudor Jones’ career offers many lessons for investors and entrepreneurs. Here are some of the key takeaways:

- Take calculated risks: Jones’ success as an investor is due in large part to his willingness to take calculated risks. He carefully weighs the potential rewards and risks of each investment and uses a variety of tools to manage his downside risk.

- Focus on macroeconomic trends: Jones’ investment approach involves taking positions on large macroeconomic trends. He believes that understanding these trends is essential to making successful investments.

- Have a strong risk management approach: Despite his reputation for risk-taking, Jones has always had a strong focus on risk management. He uses a variety of tools to manage his downside risk, including stop-loss orders and portfolio diversification.

- Be willing to make contrarian bets: Jones has made a career out of taking contrarian positions that were often out of step with the rest of the market. This approach requires a willingness to go against the crowd and the ability to see trends before they become apparent to others.

- Use your success to make a positive impact: Jones has used his success as an investor to make a significant impact in the world of philanthropy and social impact. He has founded the Robin Hood Foundation and has pledged to donate $1 billion to address climate change.

Conclusion

Paul Tudor Jones is a legendary hedge fund manager who has achieved tremendous success in his career. He is known for his aggressive, high-risk investment style, his prescient calls on major market events, and his strong focus on risk management. Jones’ career offers many lessons for investors and entrepreneurs, including the importance of taking calculated risks, focusing on macroeconomic trends, and having a strong risk management approach. Jones’ success has also enabled him to make a significant impact in the world of philanthropy and social impact, demonstrating that success in business can be used to make a positive difference in the world.

Found this fund manager’s ideologies very interesting. Thanks for picking a very engaging one!