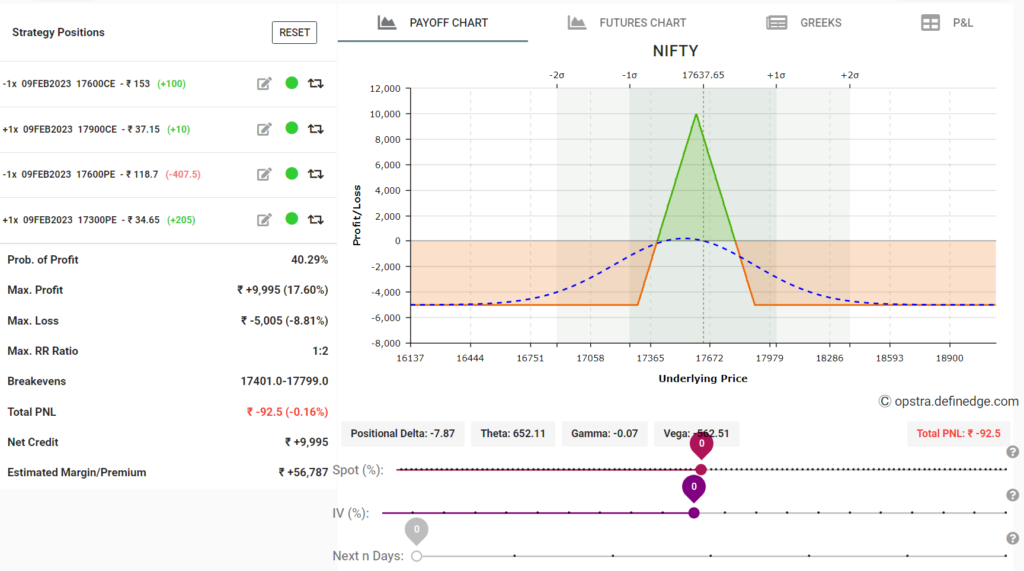

Hello all, keeping the post a bit short today as we’ve got a neat two day break for the weekend, plus fridays are usually light on positions as well. With the overall Adani situation going on, a lot of Mutual Funds and investors who entered late would be stuck for a while now. Overall, we see Nifty consolidating in the 17500-600 range for the last few days, and with a gap up opening today, we’ve to see how it plays out – whether gap gets filled and more upside, or weekly close shall remain in the same price band. One small trade which can be deployed for a slight bit of overnight theta decay would be an ironfly at 17600, with 17300 PE and 17900 CE as the hedges. This leaves us with a 1:2 RR and breakevens of 17400 and 17800 on both sides.

Moving on to the Adani scenario, let’s say, just like it’s hard to call a top for bubbles like Adani it’s hard to call the bottom as well. Sentiments have turned sour, people stuck at higher level will not get easy exit. Don’t get anchored to the peak price. We are not going to see that levels again for long long time. Adani Enterprises down 70% from recent high and still going down in lower circuits, and still, people want to catch the falling knife, thinking it will go back up after it stops falling. It’s not so easy, this isn’t like the covid crash. Stay safe, make prudent investment decisions. Have a good trading day, and may the force be with you!

Disclaimer: this post is for educational purposes only, we are not SEBI registered analysts. Trade mentioned here is not a trade recommendation. Equity Investments are subject to 100% market risk, please consult your financial advisor before investing.