Hello reader, hope you’re doing well. Markets are likely to see a weak opening in Monday trades owing to pessimism across the Asian indices. While intra-day volatility will persist, both CPI and WPI numbers for July to be announced after the market hours will be keenly watched, especially at a time when interest rate levels across the globe remain elevated due to perennially high inflation. Also, the FII camp is in a sell mode this month and have offloaded shares worth Rs 4,702 crore in the previous week, which is making investors jittery in the wake of global economic uncertainty. Investors will pay close attention to the minutes of the Federal Reserve’s July policy meeting to trickle in on August 16.

Important points to note:

- Nifty sustaining below 19300 will increase the chances of a retest of 18800-900 zone soon.

- Banknifty similarly needs to hold 43800 levels, else the chances are good we see 43500-43000 levels on the index from here.

- SBI is at a pretty good level for accumulation for long term portfolios, a good 20%+ upside potential from current levels.

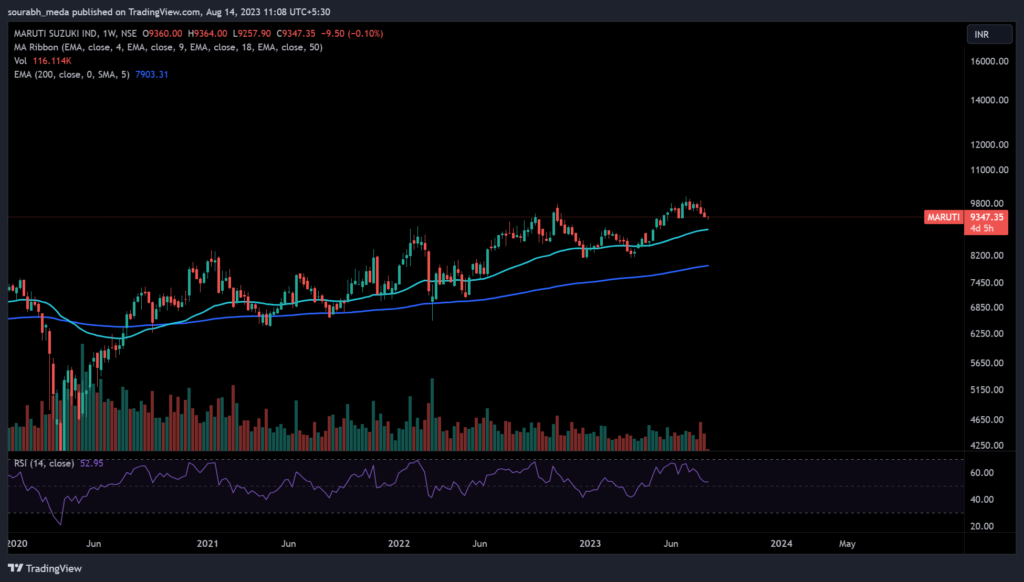

- Similar view for Maruti as well, a good accumulation point for long term portfolio at current levels.

The most underrated investing skill is lacking FOMO.

As always, risk management is key, and a proper system in place prevents one from losing out too much, in case of outlier events. Have a good trading day, and may the force be with you!

Disclaimer: this post is for educational purposes only, we are not SEBI registered analysts. Trades mentioned here are not trade recommendations. Equity Investments are subject to 100% market risk, please consult your financial advisor before investing.