Hello reader, hope you’re doing well. Early trades today can witness a sharp decline in markets as key US indicators experienced a setback overnight due to renewed banking issues. This came to light as First Republic’s shares plummeted by 41%. The bank reported a loss of more than USD 100 billion in deposits during the quarter, following the banking sector’s largest turmoil since 2008. The next two trading days are expected to remain volatile due to the April futures and options contracts’ expiration on Thursday. Investors are also cautious as they await the upcoming Fed meeting on May 3. Sentiments are further dampened as foreign institutional investors were net sellers over the past seven trading sessions, with sales amounting to Rs 5100 crore. Technically, Nifty is likely to face difficulty as long as 17863 remains a ceiling.

Important points to note:

- Nifty to consolidate within the zone of 17600-17800 for this expiry based on OI data, highest concentration at 17600 & 17700 on the PE side, 17700 and 17800 on the CE side.

- Nifty PSE still remains one of the strongest sectors, yet to give a good breakout on the upside for new ATH levels.

- PSU banks reaching a profit booking level right now, can expect a dip for further upside.

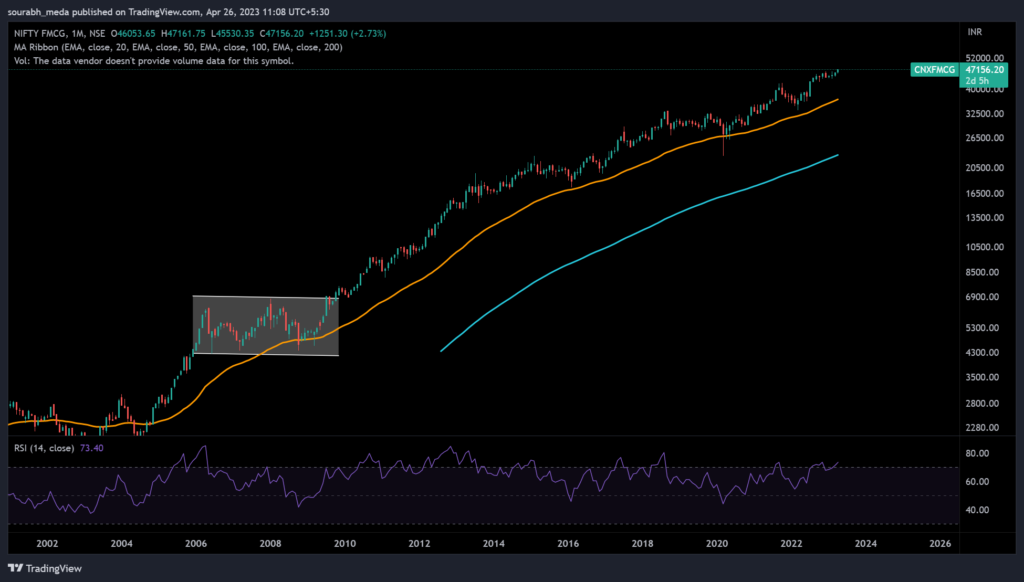

- Nifty FMCG last 2 decades is one of the smoothest charts out there. Value investors have been calling a top on this every year since 2014 but it has only gained from strength to strength producing many multi-bagger stories. Individual stocks have been through griding phase but index has had a smooth run.

As always, risk management is key, and a proper system in place prevents one from losing out too much, in case of outlier events. Have a good trading day, and may the force be with you!

Disclaimer: this post is for educational purposes only, we are not SEBI registered analysts. Trades mentioned here are not trade recommendations. Equity Investments are subject to 100% market risk, please consult your financial advisor before investing.