Hello reader, hope you’ve had a good weekend. Today’s trading session is expected to see a strong start in the markets, aligned with the upward trend observed in SGX Nifty, despite mixed trading in most Asian indices. The corporate earnings of ICICI Bank and Reliance Industries have met market expectations, which could drive activity in their shares today. Nevertheless, this week’s trading is likely to remain volatile due to the expiry of April futures & options contracts on Thursday. Technically speaking, the Nifty is expected to find support at 17443, but it can only be deemed strong if it crosses the 17863 mark. For Bank Nifty, the crucial support level is at 41799.

Important points to note:

- Nifty is still in a consolidation phase between the range of 17500-800.

- India VIX near 52 week lows of sub-12 levels.

- The one important thing to watch out for is the strength in banking stocks in the last 2 weeks – Nifty around the same levels but Banknifty about 2000 points higher, with PSU banks showing some good strength, poised for a breakout.

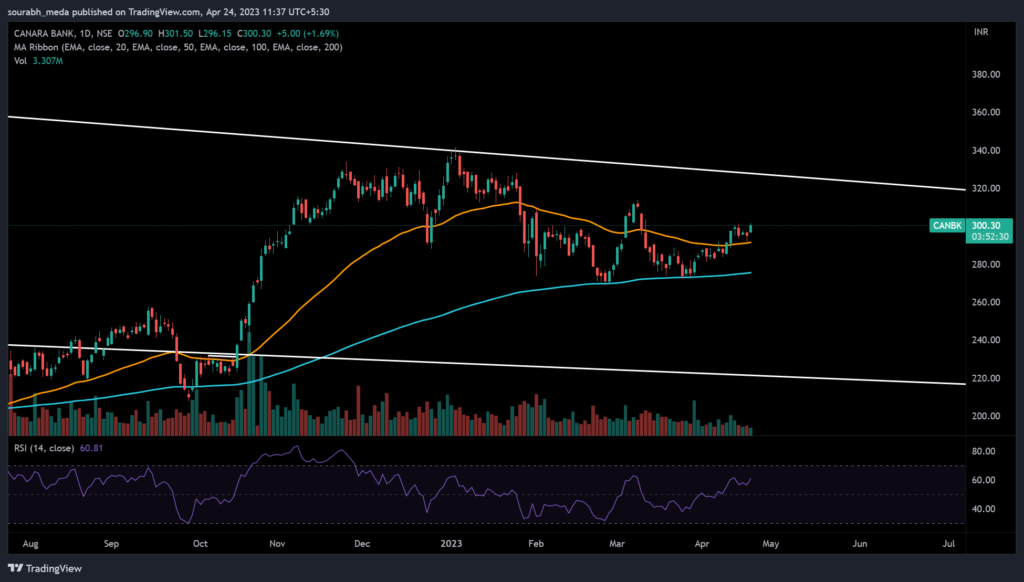

- Canara bank and SBIN are the leaders in PSU space, with both of them having a similar breakout level pattern, charts shared below –

- SBI crossing 200-EMA levels and sustaining above it is key, and similarly for Canbk, it’s taken support twice at the same levels of 200-EMA, hence with RSI slowly moving above 62 levels, can bring in good momentum in this counter on the upside.

- Nifty IT consoslidating at it’s 52 week low levels, a break from here will bring in more downside and weakness in all IT stocks.

- Nifty PSE still lingering and consolidating near ATH levels, a good breakout from here fueled by NTPC and Powergrid should do the trick.

- 17700 is going to be a key resistance point for this week with the highest OI concentration there, value being almost 2.1cr on this single strike.

As always, risk management is key, and a proper system in place prevents one from losing out too much, in case of outlier events. Have a good trading day, and may the force be with you!

Disclaimer: this post is for educational purposes only, we are not SEBI registered analysts. Trades mentioned here are not trade recommendations. Equity Investments are subject to 100% market risk, please consult your financial advisor before investing.