Hello reader, hope you’re doing well. Markets today are expected begin with minor gains, but the unfavorable trends in other Asian markets could pull down the local shares and lead to a period of lateral movement during the day. The primary reason for this pessimism is the resurgence of Fed hawks, and traders are presently factoring in an 86% probability of a 25 basis point hike in May. Nevertheless, the decreasing global crude oil prices offer some comfort to the unenthusiastic markets. Based on the technical analysis, it appears that some consolidation might occur due to overbought conditions on the daily charts. The Nifty is anticipated to receive support at the 17443 level for the interweek, and intraday support is expected at the 17561 level. The index could encounter immediate obstacles at levels ranging from 17863 to 18157.

Important points to note:

- Nifty is currently consolidating around 17600 levels which is just above the 200 EMA mark as well, forming a higher bottom too.

- PCR on Nifty currently at 0.83, not so much of a bearish bias.

- Banknifty has the highest OI concentration at 42300 CE, major resistance at this level for the index.

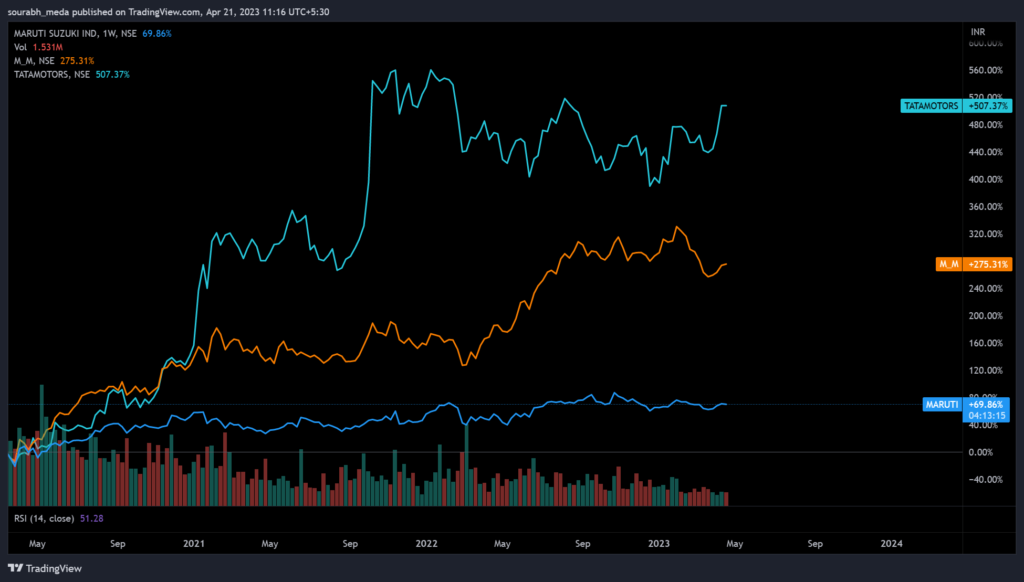

- Maruti has underperformed M&M and Tata Motors significantly since the Covid bottom, partly because TaMo & M&M had extremely attractive valuations back then, but now with auto sector looking good for an investment bet, Maruti would be a pretty good largecap bet. Chart shared below –

As always, risk management is key, and a proper system in place prevents one from losing out too much, in case of outlier events. Have a good trading day, and may the force be with you!

Disclaimer: this post is for educational purposes only, we are not SEBI registered analysts. Trades mentioned here are not trade recommendations. Equity Investments are subject to 100% market risk, please consult your financial advisor before investing.