Hello reader, hope you’re doing well. Today, it is possible that markets will open strongly due to a rise in SGX Nifty, but there are mixed trends in other Asian markets. However, during the day, local benchmarks may move sideways because concerns about more rate hikes in key European economies and the US may dampen sentiment and lead to further corrections. The selling by FIIs in the last two trading sessions, amounting to Rs 1,357 crore, has also affected sentiments negatively. According to technical analysis, Nifty may experience more corrections and increased volatility, with the biggest support at its 200 DMA at the 17588 level. The index’s main hurdle is at the 17863 level.

Important points to note:

- Nifty likely to consolidate in the range of 17500-700 for today, being the penultimate expiry session in the April series.

- Highest OI concentration seen at 17600 on the PE side and 17700 on the CE side. Tight 100 point range for the day based on OI data.

- PCR at 0.75, being rangebound with a slight bearish bias.

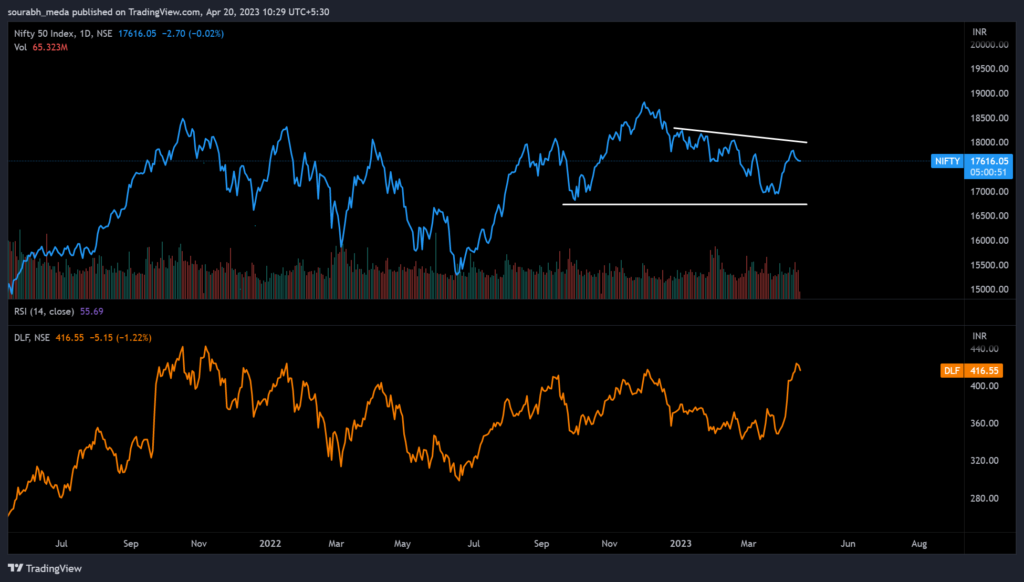

- DLF being one of the strong outperformers in the realty space, and this can be seen with a simple comparison of both Nifty 50 and DLF, as shown below –

- While Nifty was around 18800, DLF made a high of 418. Nifty currently around 17600, DLF at 420 levels. This shows you that there is good momentum in this space and stock once we start with a fresh rally in the index too.

Another key thing to remember is that 2023 is not 2020. There are no pockets of supervalue. Not even PSU banks/Autos/Pharma/IT despite the sharp fall. Its not going to be as easy to make money in 2023 as it was in 2020/21. It will be about creating a good portfolio and not about multibaggers. Opportunities like 2020 come very rarely and we shouldn’t anchor our expectations to what happened after March 2020.

As always, risk management is key, and a proper system in place prevents one from losing out too much, in case of outlier events. Have a good trading day, and may the force be with you!

Disclaimer: this post is for educational purposes only, we are not SEBI registered analysts. Trades mentioned here are not trade recommendations. Equity Investments are subject to 100% market risk, please consult your financial advisor before investing.

Well, that’s a nice dose of reality!