Hello reader, hope you’ve had a good weekend. Asian markets’ weakness, as well as SGX Nifty, will impact the local indices early trades today, following the US indexes’ decline on Friday. The lower performance was attributed to the hawkish Fed tone and poor retail sales data. Furthermore, the disappointing Q4 results of TCS and Infosys, which fell short of market expectations, are also contributing to the negative sentiment. Additionally, investors are expected to pay attention to the Wholesale Price Index (WPI) for March, which could reveal an inflation rate of 3.85%.

Important points to note:

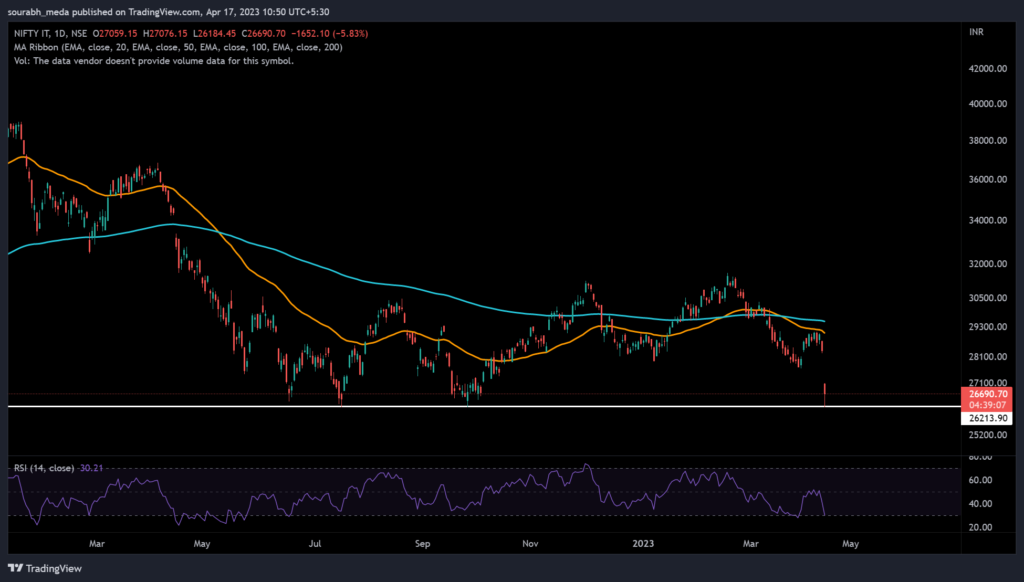

- Nifty IT being the main dragger in the index today, post Infy’s disappointing results.

- Similarly, HDFC twins are the two other heavyweights dragging Nifty down for today.

- Nifty IT has given a breakdown from the consolidation range of the last 1 year, a close below 26000 levels will open the doors for more downside. It is close to key support levels which have been held multiple times last year, so we’ve to see how it plays out.

- Reliance and PSE sector holding Nifty and helping it inch upwards slowly.

- Powergrid being the top gainer in PSE sector for today, along with being one of the two heavyweights in the index along with NTPC, which helps it gear up for a good breakout towards new all time highs.

- ITC another top gainer which has given a key breakout, forming a new ATH.

As always, risk management is key, and a proper system in place prevents one from losing out too much, in case of outlier events. Have a good trading day, and may the force be with you!

Disclaimer: this post is for educational purposes only, we are not SEBI registered analysts. Trades mentioned here are not trade recommendations. Equity Investments are subject to 100% market risk, please consult your financial advisor before investing.