Hello reader, hope you’ve been doing well. Back here after a short break, as I’d been travelling for work. Continuing with the ongoing theme, markets may see sharp sideways movement on either side during intra-day trade due to lack of firm cues from global equities. Select auto stocks could be in focus which will react to monthly sales numbers to be announced today. Other than weak global macros, India’s rainfall deficit last month is a cause of concern as any extended dry spell could further worsen the sentiment.

Important points to note:

- Nifty has been in a lengthy corrective phase for more than 1.5 months now, but once we cross the 19650 mark we’re in for a fresh rally upto 21000 levels.

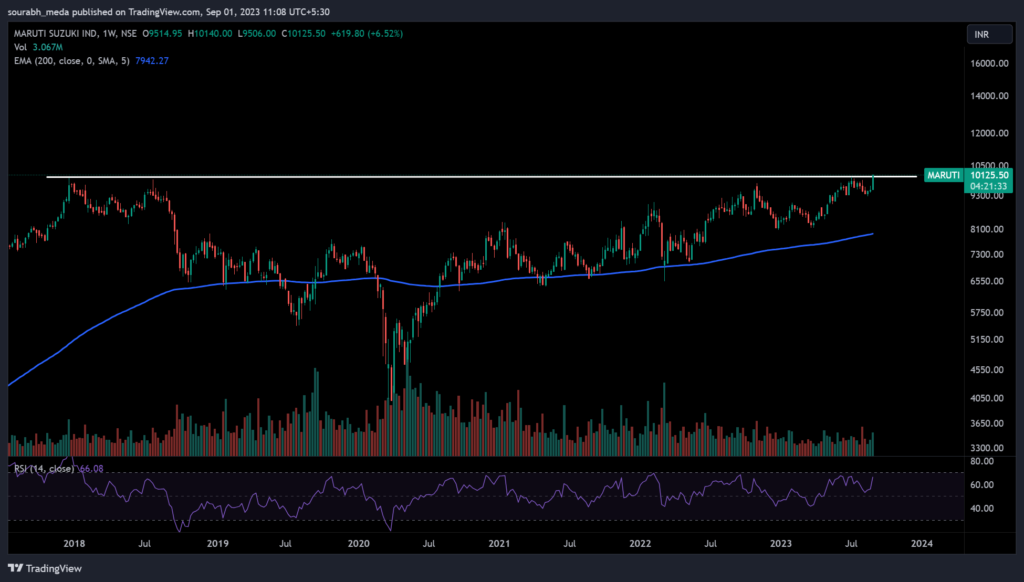

- Maruti has successfully broken out into a fresh ATH zone, which indicates the beginning of a good upside from current levels. First time it hit this level was in 2017, then again in 2018, and finally now once in July and again today.

- In the PSE basket, two stocks to watch out for are Coal India and GAIL, with good potential for a 10% upside from current levels.

- PSU banks are also gearing up for a good rally from current levels, stronger ones to watch out for being Canara Bank, SBI, Bank of Baroda and Federal bank.

- With today being the first day of the september monthly series but also the final closing day for the week, we can expect a dip in volatility also fueled by the drop in INDIA VIX.

As always, risk management is key, and a proper system in place prevents one from losing out too much, in case of outlier events. Have a good trading day, and may the force be with you!

Disclaimer: this post is for educational purposes only, we are not SEBI registered analysts. Trades mentioned here are not trade recommendations. Equity Investments are subject to 100% market risk, please consult your financial advisor before investing.