Hello reader, hope you’ve had a good weekend. After reviewing last week’s events, the Federal Reserve increased rates by 25 basis points as predicted, but suggested that they would now take a break. Meanwhile, the European Central Bank also raised rates by 25 basis points, but President Lagarde acknowledged that there is still more work to be done and that the bank is not pausing due to significant inflation. Finally, the United States released a job report that exceeded expectations towards the end of the week. Despite all of this news and data, the US dollar index remained stagnant, fluctuating between 100.50 and 101.30 without a clear trend.

Important points to note:

- Nifty crossing the key point of 18200 today will bring in more momentum on the upside.

- Nifty PSE still remains one of the strongest sectors, this basket is poised to outperform in the next few months.

- We’ve seen a substantial increase in OI at 18200 PE levels, data-wise this is good for an upmove in the index from here.

- PSU banks as mentioned earlier to face profit booking at current levels, can add further on dips, to avail better pricing for longer term investments.

- ITC at current price levels of 432.5, this can be a good short/medium term top in this stock post such a good rally in the last 14 months.

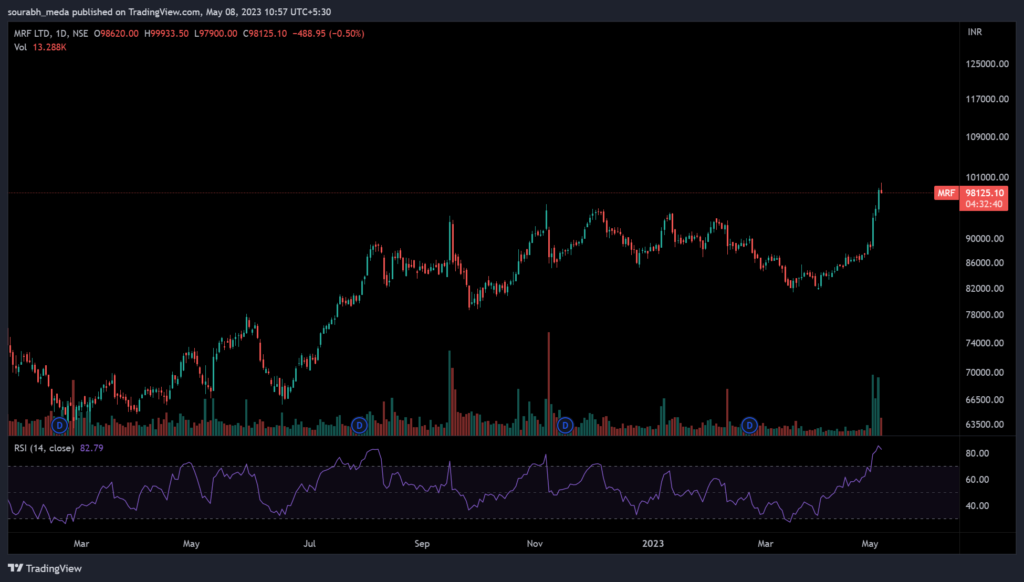

- MRF currently trading at 98126 levels, day’s high being 99933.50, will it be the first stock in India to hit the six-digit figure? Charts shared below –

As always, risk management is key, and a proper system in place prevents one from losing out too much, in case of outlier events. Have a good trading day, and may the force be with you!

Disclaimer: this post is for educational purposes only, we are not SEBI registered analysts. Trades mentioned here are not trade recommendations. Equity Investments are subject to 100% market risk, please consult your financial advisor before investing.