Hello reader, hope you’re doing well. Local equities may struggle in early trades, taking cues from weak overnight US markets after the US Fed in its policy meeting hiked rates once again, which was more on expected lines. The street will be a bit apprehensive as the Fed indicated that it is prepared for more such steps in future. While local markets may see sideways movement, investors would be cautious of the global trend, especially in the wake of recession fears and falling crude oil prices.

Important points to note:

- With today being the first expiry session of the May series, it’s key to note we’re starting off on a bullish undertone with 18000 level being a key support zone now, on Nifty.

- Highest OI for today being on 18200 CE levels and 18100 PE levels, with both at around 2.15cr and 1.99cr OI values currently.

- India VIX currently under 12 levels, indicating low volatility and stability in the markets.

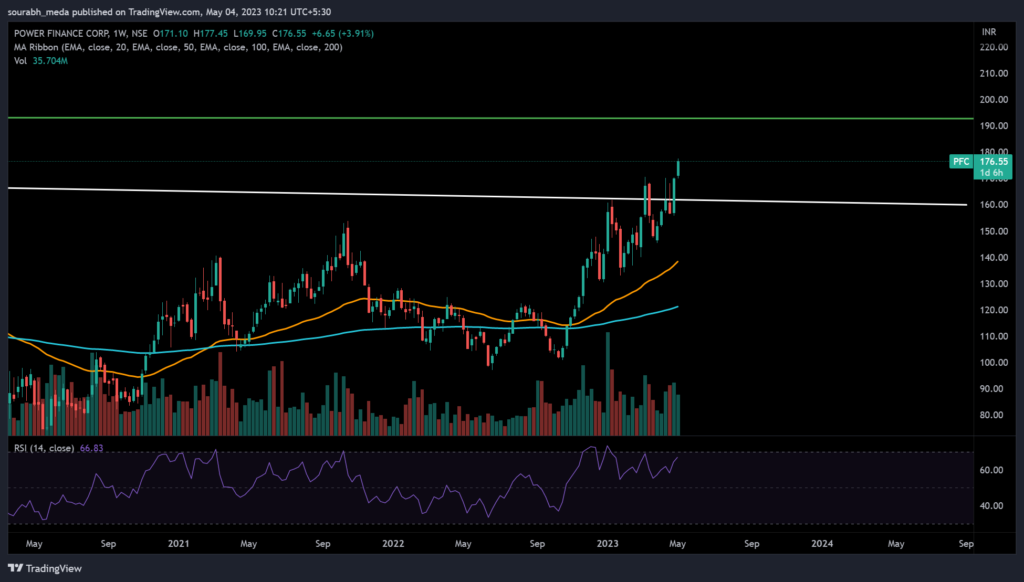

- PFC being one of the top gainers in the PSE basket for today, up by 3.5% and on course to reach 190 levels in near term, breakout done on weekly chart as well, chart shared below –

- 43500 being a key resistance point on Banknifty for today, with 86L OI at this strike (43500 CE), highest being on 43300 PE with 80L OI at this level.

As always, risk management is key, and a proper system in place prevents one from losing out too much, in case of outlier events. Have a good trading day, and may the force be with you!

Disclaimer: this post is for educational purposes only, we are not SEBI registered analysts. Trades mentioned here are not trade recommendations. Equity Investments are subject to 100% market risk, please consult your financial advisor before investing.