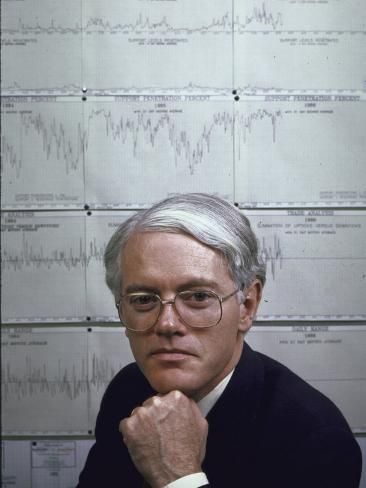

Peter Lynch is a legendary figure in the world of investing, known for his successful management of the Fidelity Magellan Fund in the 1980s. His investing philosophy and approach have been studied and admired by many, and his influence can still be felt in the investing world today.

Early Life and Career

Peter Lynch was born in 1944 in Newton, Massachusetts, and grew up in a middle-class family. He attended Boston College and graduated in 1965 with a degree in finance. After graduation, he worked as a summer intern at Fidelity Investments and was offered a full-time position after graduation.

Lynch began his career at Fidelity as an analyst, researching and recommending stocks to portfolio managers. He quickly rose through the ranks and became the manager of the Fidelity Magellan Fund in 1977, when it had just $18 million in assets under management. Over the next 13 years, Lynch grew the fund to $14 billion, making it the largest mutual fund in the world at the time.

Investing Philosophy

Lynch’s investing philosophy was simple and focused on finding undervalued companies with strong growth potential. He believed that individual investors could find great investment opportunities by paying attention to their everyday lives and the products and services they use.

Lynch famously coined the term “invest in what you know” to describe his approach to investing. He believed that by investing in companies that people use and understand, investors could gain a better understanding of the company’s prospects and potential for growth.

Lynch also emphasized the importance of doing thorough research before investing in a company. He would read annual reports, talk to industry experts, and even visit the companies he was considering investing in to gain a deeper understanding of their operations and potential.

Legacy and Influence

Lynch retired from Fidelity in 1990 but has remained an influential figure in the investing world. He has written several books on investing, including “One Up On Wall Street” and “Beating the Street,” which have become classics in the investing world.

Lynch’s influence can also be seen in the many successful investors who have followed his approach, including Warren Buffett and Bill Miller. Both Buffett and Miller have praised Lynch’s approach to investing and credited him with inspiring their own successful investment strategies.

In conclusion, Peter Lynch is a true investing legend whose approach to investing has had a lasting impact on the investing world. His focus on finding undervalued companies with strong growth potential and his emphasis on doing thorough research have inspired countless investors and continue to be relevant today.

Very interesting!