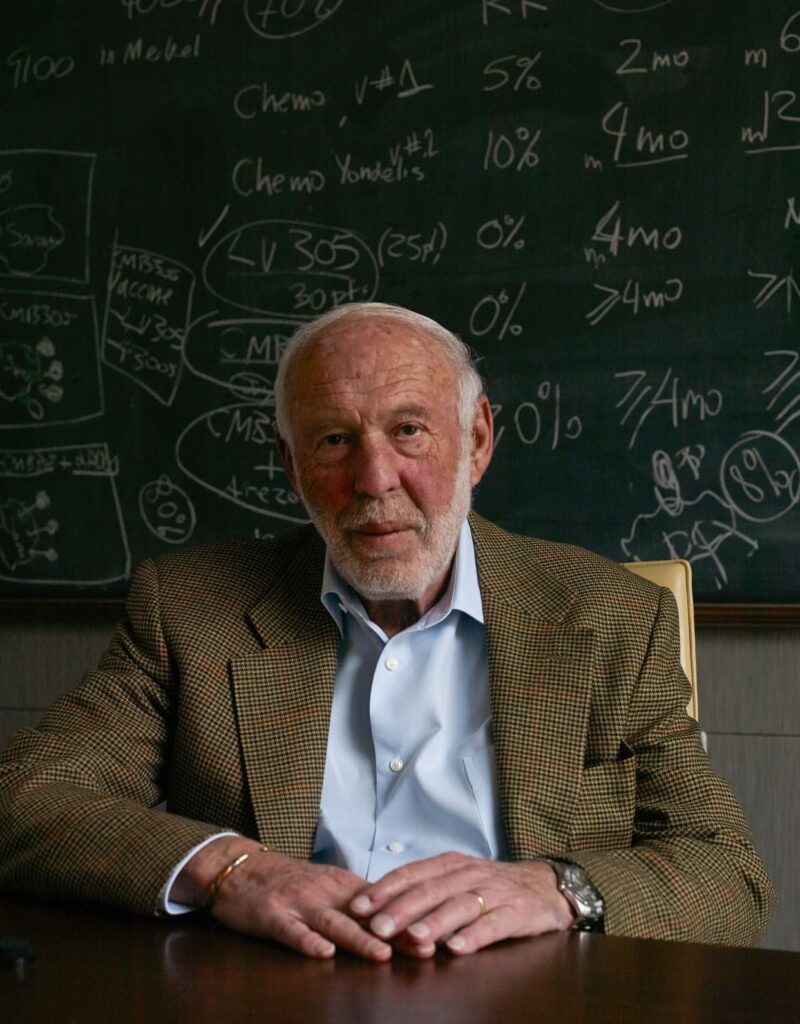

Jim Simons is a name that is synonymous with groundbreaking research in mathematics and finance. He is widely considered one of the most successful hedge fund managers in history, having built Renaissance Technologies, a firm that has consistently produced remarkable returns on its investments.

Born in 1938 in Massachusetts, Simons was a child prodigy who excelled in mathematics from a young age. He earned his bachelor’s degree in mathematics from MIT in 1958, followed by a Ph.D. in mathematics from the University of California, Berkeley in 1961.

Simons started his career as a mathematics professor, teaching at Harvard and MIT. In the late 1970s, he left academia to pursue a career in finance. He started by applying his mathematical expertise to trading currencies, but quickly moved on to more complex financial instruments such as options and futures.

In 1982, Simons founded Renaissance Technologies, which he built around a core team of mathematicians and scientists. He believed that quantitative analysis and mathematical models could be used to predict market movements and generate superior investment returns. His team developed complex algorithms that analyzed vast amounts of data, looking for patterns and anomalies that could be exploited.

Simons’ approach was radically different from traditional methods of investment, which relied on human intuition and judgment. He believed that the key to successful investing was to remove human biases and emotions from the decision-making process. His algorithms could process huge amounts of data and make investment decisions based solely on mathematical models.

The results were astonishing. Renaissance Technologies produced annual returns of over 30% for its flagship Medallion fund, making it one of the most successful hedge funds in history. Simons himself became one of the wealthiest people in the world, with a net worth of over $20 billion.

Simons’ success has not gone unnoticed. He is a sought-after speaker and has received numerous awards for his contributions to mathematics and finance. He has also been a prominent philanthropist, donating hundreds of millions of dollars to charitable causes.

Despite his incredible success, Simons remains a deeply private person. He rarely gives interviews or talks about his personal life, preferring to focus on his work and philanthropic efforts. He has been married twice and has five children.

Jim Simons’ legacy is one of innovation, creativity, and analytical rigor. He has transformed the world of finance by applying mathematical models to investment decisions, and his work has inspired a generation of mathematicians and scientists. His success has also demonstrated the power of quantitative analysis in finance, and his approach is likely to continue shaping the industry for years to come.