Hello reader, hope you’ve had a good weekend, and we’re keeping today’s post short and sweet as well. Nifty is currently in the 17600-17900 range, while in the process of forming a base at it’s 200 EMA support level. The key resistance point to cross now would be 18000 (which is also the 50 EMA level, usually acts as a short term support and resistance level), and once 18200 is crossed, we shall be able to see more upside. Why we say the bottom formation process is underway here, is because in the recent correction, PCR had gone to a major low below 0.5 and that usually works as another indicator of oversold levels on charts. Currently PCR is around 0.85 – 0.9 which has caught up with it’s mean levels, and once our stronger sectors (Nifty PSE and Nifty Auto) perform well along with the largecaps, we can see a good bounce from here.

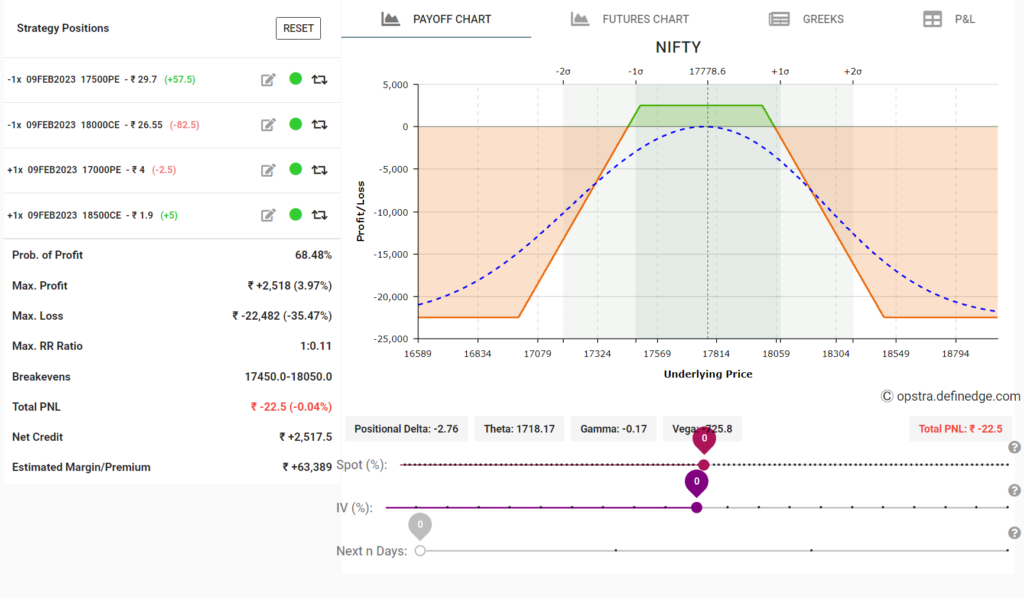

A simple trade that can be done on nifty would be selling 17500 PE and 18000 CE, which would be a simple strangle with a 500 point range, along with buying 17000 PE and 18500 CE as the buy legs to avail the margin benefit. Have a good trading day, and may the force be with you!

Disclaimer: this post is for educational purposes only, we are not SEBI registered analysts. Trade mentioned here is not a trade recommendation. Equity Investments are subject to 100% market risk, please consult your financial advisor before investing.